It’s arduous to consider that I’ve been working within the funds and monetary providers sectors for over twenty years. A lot has modified throughout that point. We’ve seen new market entrants, shifts in enterprise practices, and the emergence of digital methods which have reworked how providers are delivered. Nonetheless, a lot has additionally remained the identical, notably in how folks in finance strategy their day-to-day duties.

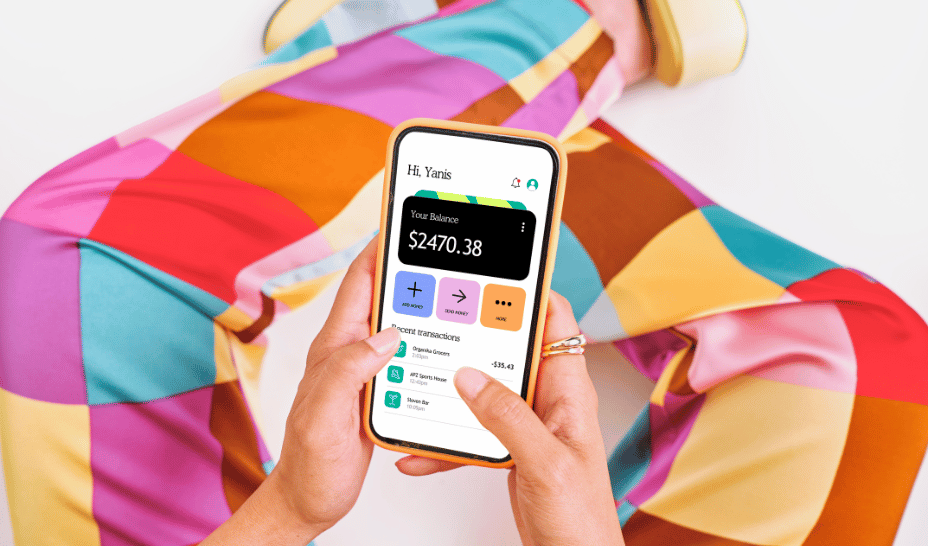

Till just lately, these of us working in these fields had been nonetheless grappling with the identical points I encountered within the early years of my profession. People throughout the funds and monetary providers sectors proceed to have to change between totally different options to get duties accomplished, in a phenomenon typically dubbed ‘swivel-chairing’. For instance, think about you’re making ready an inventory of suppliers to pay in an accounting instrument. When it’s time to make the funds, it’s a must to log into your financial institution app on a separate display.

Going from one to the opposite is a traditional case of ‘swivel-chairing’, which hinders finance and accounting professionals from reaching full productiveness. Research has discovered that the typical workplace employee spends 1.5 hours copying and pasting knowledge from one enterprise software to a different (e.g. spreadsheet to CRM, CRM to ERP), which has created an enormous alternative to take away swivel-chairing amongst small- to medium-sized companies (SMBs) throughout the globe. Primarily based on our calculations, we consider the potential to combine monetary performance into digital providers might symbolize a $983bn alternative.

Tackling persistent inefficiencies in monetary providers

Regardless of a long time of change within the funds and monetary providers sectors, inefficiencies like ‘swivel-chairing’ have endured, resulting in expensive guide errors and decreased productiveness. I’ve witnessed this first-hand all through my profession. If you happen to’ve labored in finance, you seemingly have as nicely, and also you’ll perceive simply how detrimental these inefficiencies could be to finishing work in a well timed and cost-efficient method.

Firms throughout the fintech sector have been striving to sort out this and lots of related issues, aiming to make monetary providers a seamless and invisible a part of on a regular basis experiences. Whereas there was some trial and error alongside the best way, new applied sciences have now emerged which are able to addressing these workflow inefficiencies.

In the end, the aim of those new methods is to allow duties to be initiated and accomplished in a single place, eliminating the necessity to swap between screens, paperwork and different guide processes. Now, as extra corporations embrace digital transformation, the chance has arisen to combine monetary providers in ways in which not solely improve buyer experiences but additionally concurrently enhance inside enterprise processes.

Addressing the problem with BaaS

One of many preliminary approaches to reaching improved person experiences by way of the combination of economic providers was with Banking as a Service (BaaS). BaaS features like Lego: it supplies corporations with the constructing blocks—monetary providers through APIs. Nonetheless, the corporate should assemble the remaining elements themselves. Consequently, the BaaS mannequin locations a major burden on center and back-office groups, comparable to operations, compliance and finance. There’s a complete new monetary world for them to familiarize yourself with – one which comes with dangers.

Oftentimes, the dimensions of the extra folks and processes required to efficiently function a BaaS programme is simply an excessive amount of to simply accept. Furthermore, if the dangers related to BaaS usually are not totally managed, regulators will intervene — they usually have. Over the previous few years, we’ve seen a significant push by regulators to make sure these working underneath the BaaS mannequin are doing so in a compliant method.

Whereas fintechs might really feel extra outfitted to deal with the problem, most non-financial corporations battle to fulfill these necessities and are uncomfortable inserting such a major burden on their help groups. For these corporations that do undertake BaaS, there’s a necessity to speculate closely in constructing the mandatory groups, processes and infrastructure to handle it—an strategy that’s removed from ultimate, and extra critically, takes them outdoors their core enterprise.

Overcoming Obstacles

Overcoming these challenges is essential if we’re to totally unlock the potential of integrating monetary performance into digital providers to scale back points like ‘swivel-chairing’. Nonetheless, whereas corporations outdoors the finance and fintech sectors—comparable to software program corporations—recognise the aggressive benefits of this integration, they’re hamstrung by the numerous funding required to grasp their ambitions, inevitably slowing adoption charges.

Against this, embedded finance really excels on this regard. The expertise permits corporations to realize this integration with out the necessity to overburden center and again workplace groups with extra obligations. With embedded finance, the product, processes and safety are bundled collectively to seamlessly combine monetary providers into on a regular basis workflows. The result’s a mannequin that reduces the danger, value and complexity related to earlier approaches like BaaS.

Throughout the fintech and tech sectors, we’re already seeing wonderful examples of corporations leveraging this expertise to embed monetary providers into their platforms. The mixing permits corporations to construct stronger merchandise with enhanced person expertise, leading to greater engagement, elevated buyer retention, and, in lots of circumstances, a 2x to 5x rise in income per person. General, it presents a much more compelling proposition for industrial and product groups than BaaS.

Embedded Finance: The Subsequent Evolution

Shifting ahead, embedded finance is changing into an more and more necessary consideration for companies throughout a spread of sectors, together with B2B SaaS. Earlier this 12 months, we revealed a report “The Next Step for B2B SaaS“, which discovered that just about three-quarters of software-as-a-service product managers within the UK plan to implement embedded finance as a part of their future roadmap. The analysis highlights why analysts count on the worldwide market to develop exponentially within the coming years.

Because the regulatory surroundings turns into more and more stringent, the worth of embedded finance is extra obvious than ever. Whereas BaaS provides flexibility, it additionally requires vital effort, with corporations needing to handle a lot of the burden themselves. Moreover, new rules imply that BaaS suppliers should now impose even better calls for on their prospects. For a lot of corporations, notably start-ups, this demand is just too overwhelming. Thankfully, the rise of embedded finance provides a sturdy various.

Consequently, the expertise is poised to remodel a number of business-critical duties the place ‘swivel-chairing’ stays frequent. Succeeding the place BaaS has fallen brief, embedded finance is more likely to play a pivotal function within the subsequent wave of digital transformation throughout industries, with the potential to unlock the aforementioned $983 billion alternative associated to integrating monetary performance into digital providers.