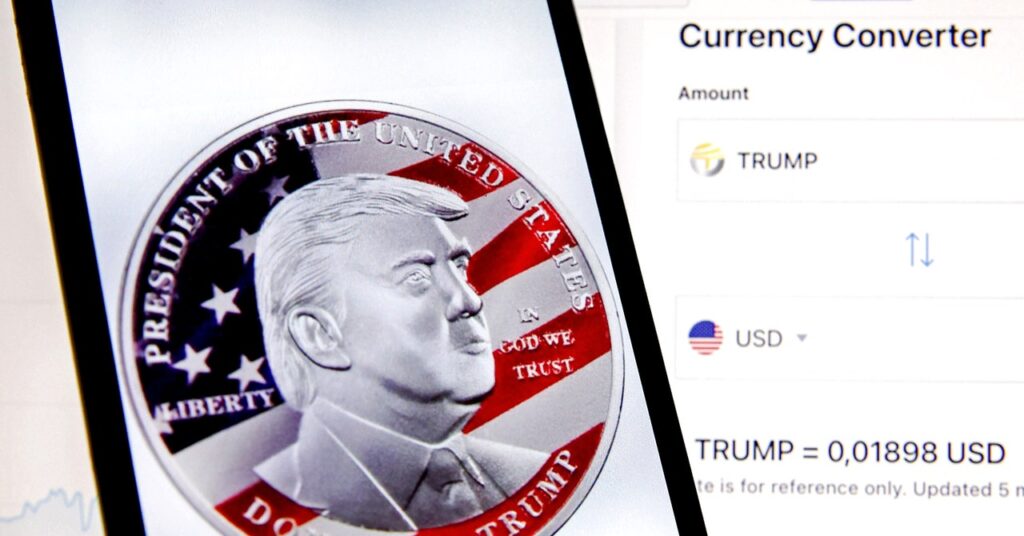

The crypto wallets that invested the biggest sums in TRUMP largely bought the coin on January 18, the day it launched, in accordance with Nansen evaluation. The wallets that achieved the best return on their TRUMP investments, in the meantime, had largely bought off their holdings by January 20, by which era the value had already tumbled from its peak. The circulating TRUMP cash are actually valued at $5.4 billion.

“The sooner you’re, the extra you may wager. However in the event you’ve wager quite a bit, it doesn’t make sense to remain a very long time, as a result of it’s not going to be [the next] Apple or Nvidia,” says Barthere. “There’s zero worth. So for certain it’s going to go down.”

Among the many wallets which have profited most handsomely from TRUMP, Nansen knowledge reveals, are many who dealt in comparatively small sums, which means that some common folks managed to beat the group in the identical means as the massive early merchants. Within the midst of the high-value trades positioned by J9tXv and others within the minutes after TRUMP launched, armchair merchants had been throwing down as little as 50 bucks.

Past an unimaginable stroke of fortune and gall, Sibenik and Powers declare, just one different concept might clarify merchants plowing lots of of 1000’s of {dollars} into TRUMP so quickly after it was unveiled: The trades had been positioned by automated sniping bots.

Sniping bots are usually programmed to grab up a number of completely different cash instantly after launch, says Powers. Among the wallets used to position the early high-value TRUMP trades do contain tens of other memecoins, however others, together with J9tXv, comprise only some.

“What we’d not count on to see from a bot can be an acquisition of 1 token solely with a big place, particularly if that token hadn’t been beforehand introduced. That exercise appears too particular,” says Powers. “How do you code the script for a bot to amass one token earlier than it exists?”

Most sniping bots are additionally programmed to deal in smaller greenback quantities, says Sibenik. “[The big early traders] both being insiders or having perception from one other social gathering are extra seemingly explanations, particularly given the very massive quantities invested,” Sibenik says.

Within the absence of any guidelines governing memecoins within the US, it might not essentially be unlawful for an issuer to provide early discover to pick out events.

Lately, a number of federal lawsuits brought by investors have sought to argue that memecoins ought to fall underneath securities legal guidelines, ruled by the Securities and Change Fee, a regulatory company tasked with defending US traders. However in an interview on January 23, enterprise capitalist David Sacks, appointed by Trump because the US AI and crypto czar, claimed that memecoins must be handled as a sort of collectible, an unregulated asset class.

In an government order signed on January 23, Trump established a “working group on digital assets,” which he tasked with recommending applicable crypto-related regulation and laws.

“The cryptocurrency trade remains to be driving for readability on regulation. The key gamers need to be seen nearly as good religion actors in monetary markets,” says Powers. “There was some disgruntlement expressed from throughout the [crypto] trade of this memecoin providing seeming to benefit from the second.”

On the foot of the TRUMP website, a small-print disclaimer asserts that the memecoin is “not supposed to be, or to be the topic of, an funding alternative, funding contract, or safety of any sort.” The terms and conditions, in the meantime, stipulate that traders should waive the correct to carry a category motion lawsuit in relation to the memecoin. In addition they declare that traders aren’t entitled to pursue damages, even within the occasion of “misleading and unfair commerce practices” and “misrepresentation” on the a part of the Trump-affiliated firm administering the coin.

“That’s a surprising caveat,” says Powers. “Whether or not these sorts of waivers and disclaimers would really maintain up in courtroom is one other matter. However setting down the highway with that perspective is just not in step with the hope of the crypto trade to show the web page on what got here earlier than.”