Copenhagen-based early-stage investor PSV Tech at the moment broadcasts the launch of Tech Fund II with a goal of €70 million, aiming to strengthen the Nordic area’s place as a technological powerhouse in Europe by investing in AI, software program, and digital infrastructure startups.

PSV Tech’s second fund is backed by traders similar to ATP, EIFO, and The Danish Society of Engineers, IDA. Each ATP and EIFO have been cornerstone traders in Fund I. Among the many fund’s traders are additionally tech entrepreneurs: Christian Lund and Henrik Printzlau (Templafy), Sebastian Knutsson (King), Morten and Niels Ebbesen (Siteimprove), and Stig Myken (Hiper).

“To strengthen Europe’s competitiveness, large funding in tech entrepreneurs is crucial,” says Helle Uth, Co-founder and Basic Accomplice at PSV Tech. “Investing in expertise is now not nearly progress – it’s about Europe’s skill to function by itself phrases. By backing startups in AI, software program, and digital infrastructure on the pre-Seed stage, we purpose to construct a stronger pipeline of startups that may make Europe extra self-reliant, extra resilient, and higher outfitted for the longer term international competitors.”

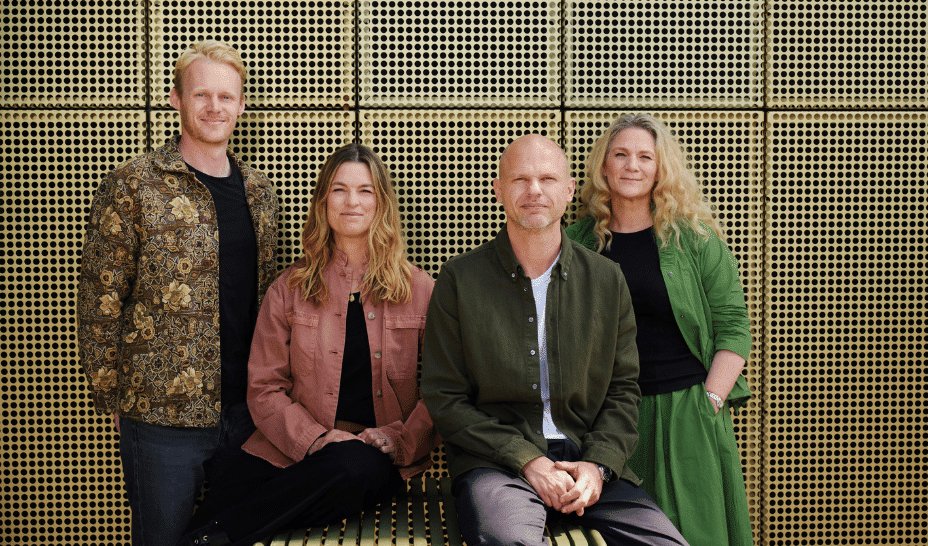

PSV Tech was launched in 2020 as a part of the PSV Enterprise Home with a mission to again Nordic Founders even earlier than product/market match. Behind the fund are 4 Basic Companions – Helle Uth, Richard Breiter, Alexander Viterbo-Horten, and Christel Piron.

As a part of PSV Enterprise Home, the fund relies at DTU (Technical College of Denmark). This integration offers PSV proprietary entry to, what they discuss with, some of the useful assets: engineering and technical expertise.

“As Denmark’s nationwide pension fund, ATP invests to make sure engaging, lifelong assured pensions. With this funding, ATP contributes to creating new Danish firms and jobs – ventures that we hope will develop into technological frontrunners, driving progress, innovation, and finally delivering returns for our members. We’ve got confidence within the PSV group, who has demonstrated their skill to establish and develop tomorrow’s winners. In at the moment’s shifting geopolitical panorama, it’s an added power that this funding helps the ambition for larger European self-reliance.” added Sabine Calmer Braad, Head of World Direct Investments at ATP

Simply 4.5 years after launching their first fund – which led to 47 investments and 6 exits, together with Helloflow and Heyhack – 65% of their new fund has already been dedicated, with two investments made to this point.

“If we wish new expertise not simply to be invented however commercialised and scaled from Denmark, we’d like robust partnerships between analysis and capital,” says Anders Bjarklev, President of DTU. “That’s why we’ve supported PSV Tech for the reason that starting – it brings capital and mentorship to the type of firms born at DTU.”

IDA Chairwoman Laura Klitgaard highlights the fund’s distinctive positioning: “At IDA, we’ve chosen to spend money on PSV Tech as a result of we purpose to guide by instance with regards to investing in tech startups. As Denmark’s largest skilled neighborhood for STEM graduates (Science, Expertise, Engineering, Arithmetic), we consider PSV Tech is a standout instance of a powerful alliance between STEM expertise, groundbreaking analysis, and capital. We’re assured that, collectively, we will pave the way in which for technological options to international challenges – each in Denmark and throughout the Nordics.”

“The extent of privilege, security web and schooling within the Nordics makes it a perfect launchpad for startups – however too typically, we’ve seen Founders go to the U.S. as a result of that’s the place the capital is,” says Sebastian Knutsson, Co-founder of King. “By backing PSV Tech, we hope to assist extra founders in constructing international firms from the Nordics.”

What started 25 years in the past as a state-funded pre-Seed funding car has laid the inspiration for PSV Tech.

“PSV Tech has performed a pivotal function in creating Denmark’s early-stage tech panorama,”notes Ida Dahl Hoem, Funding accountable at EIFO. “Following their efficiency in Fund I, we have been assured in doubling down, and we’ve excessive expectations for the group’s future efficiency.”

PSV Tech will proceed fundraising for Fund II, concentrating on traders who share its mission: to assist Nordic Founders in constructing tech firms with international attain, and in doing so, contribute to Europe’s long-term technological sovereignty.