Know-how reporter

Getty Photographs

Getty PhotographsBarclays prospects are persevering with to expertise intermittent errors with funds and transfers after critical IT issues that additionally affected the financial institution’s app and on-line banking.

Prospects have informed the BBC it’s stopping them making important transactions, starting from shopping for child milk to finishing a home transfer.

Barclays says playing cards and money machines can be utilized as regular – although some prospects have said this is not the case.

The outage started on Friday, which was pay day for many individuals within the UK, and the deadline for self-assessment tax returns.

Barclays has not defined the reason for the IT issues, or how many individuals are affected however has apologised and says it’s “working laborious to repair the difficulty”.

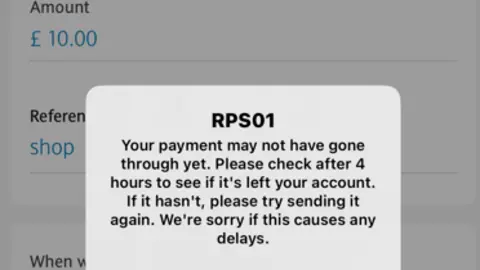

Within the early hours of Saturday morning, Barclays’ web site indicated that its app had begun working once more – however that points persevered with funds and transfers.

Prospects replying to Barclays’ announcement about the outage on social media have reacted with fury whereas reporting a collection of issues it’s inflicting them.

One stated their card had been declined regardless of them having funds – one other stated that that her January wages “had disappeared”.

A household has informed the BBC they can’t transfer into their new home due to the outage, branding the state of affairs “ridiculous”.

Scott, 27, and his spouse, who’s 4 months pregnant, stated they’d offered their home on Friday morning, however the cash for his or her new house had not gone by way of but because of the issues at Barclays.

Scott informed BBC Information they have been successfully homeless, and had been left ready of their automotive at a service station in Horsham, West Sussex.

“As a result of the system is down, the cash cannot undergo,” he stated.

“We simply have to take a seat and wait.”

BBC viewer Ruth

BBC viewer RuthRuth, 39, a self-employed cleaner, informed BBC Information she had been attempting to entry cash along with her accomplice from their financial savings account for a number of hours so she might purchase milk for a child and meals for 5 different youngsters she is taking care of at house.

“We’d like the cash to do buying, our cash is all in financial savings,” she defined.

“I’ve bought my granddaughter right here who’s 11 months previous, additionally a one-year-old, two-year-old, 12-year-old, 13-year-old, 15-year-old all at house.”

She stated she had been capable of get some assist from her teenage daughter, however stated others may not be so lucky.

“There might be many single mums in the identical state of affairs with no entry to cash,” she informed the BBC.

Barclays is among the UK’s largest banks, with over 20 million UK retail prospects. It says it processes over 40% of the UK’s credit score and debit card transactions.

Web site downdetector, which screens outages, says thousands of people have flagged problems on the financial institution. On Saturday morning, it confirmed greater than 4,000 points had been reported with Barclays, greater than double the quantity reported on Friday.

Taking to social media, one mom stated she couldn’t purchase milk for her child because of the points at Barclays.

“My four-month-old is out of milk powder and screaming for a feed and I nonetheless have not been paid,” she stated.

“I have been in tears for hours.”

Tax return nervousness

Friday was the deadline for self-assessment tax returns, and a few prospects have stated the outage has left them unable to make funds to HMRC.

Earlier on Friday, HMRC warned that millions of people have still not filed their self-assessment tax returns, and warned of £100 fines for many who didn’t meet the deadline.

Nevertheless, in assertion to the BBC, HMRC stated it was “working intently” with Barclays to minimise any affect on prospects submitting their self-assessments.

A spokesperson added: “Our providers are working as regular, so prospects will have the ability to file their returns on time. Immediately’s points is not going to lead to late cost penalties as they do not apply till 1st March.”

In an announcement, Barclays stated: “We’re in direct contact with HMRC and they’re conscious of the technical points with our system.”

It added: “We are going to make sure that no buyer is omitted of pocket due to delayed funds attributable to this incident.”

Outage after outage

It’s not the primary time banking app prospects have been left unable to entry funds or make funds.

PayPal suffered a brief but notable outage in November that impacted prospects globally throughout a variety of its merchandise, together with its cryptocurrency providers and standard US peer-to-peer cost app, Venmo.

Hundreds of UK financial institution prospects have been affected by cost issues with a few of the greatest lenders in June final 12 months, with banks together with HSBC, Nationwide, Barclays and Virgin Cash all impacted by issues with a system that facilitates funds between people and corporations.

Some cash-strapped prospects continued to really feel the consequences of the difficulty for days afterwards.

Throughout last July’s major global IT outage, a number of UK retailers have been unable to take card funds and IT providers have been unable to entry payroll after an faulty replace by antivirus firm CrowdStrike affected programs worldwide.

BCS, the Chartered Institute for IT, stated the issues with Barclays confirmed the significance of sturdy laptop programs.

“As soon as once more this goes to point out how cyber-security and digital resilience is so tightly built-in into our lives,” stated Dan Card, BCS’ cyber-security skilled.

Extra reporting by Liv McMahon