Shares in Nvidia have fallen regardless of the synthetic intelligence (AI) chip large comfortably beating expectations after greater than doubling its gross sales.

Nvidia introduced report revenues of $30bn (£24.7bn) over a three-month interval.

The corporate has been one of many greatest beneficiaries of the AI increase, with its inventory market worth hovering to greater than $3 trillion.

However whereas analysts have grown used to Nvidia producing “spectacular” gross sales progress, the most recent outcomes point out “that fee of progress was beginning to gradual,” mentioned Simon French, head of analysis at Panmure Liberum.

Analysts had forecast gross sales progress of $28.7bn for the three months to twenty-eight July.

Nvidia surpassed this with revenues growing by 122% in comparison with the identical interval final yr.

However following the discharge of the outcomes, Nvidia’s share value fell by 6% in after-hours buying and selling in New York on Wednesday.

On Thursday, its shares had been down about 2% in early buying and selling, however its inventory stays about 150% up up to now in 2024, making it one of many massive winners within the US market.

“It’s much less about simply beating estimates now,” mentioned Matt Britzman, senior fairness analyst at Hargreaves Lansdown. “Markets count on them to be shattered and it’s the size of the beat right this moment that appears to have disenchanted a contact.”

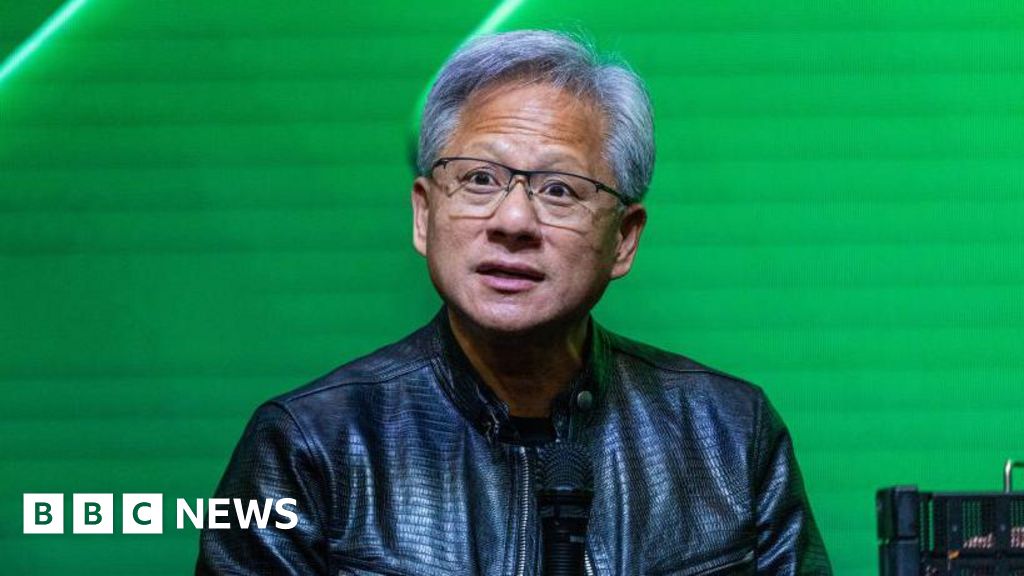

Asserting the most recent outcomes, Nvidia chief government Jensen Huang mentioned: “Generative AI will revolutionise each business.”

However Mr French advised the BBC: “For those who’re going to boost expectations that top you then’ve acquired to continue to grow at spectacular charges.”

He added that whereas its present AI chip – known as Hopper – is promoting effectively, the following era Blackwell chip “has confronted some manufacturing delays and that maybe is likely one of the explanation why Wall Road after hours offered off the inventory”.

Nvidia’s outcomes have change into a quarterly occasion which sends Wall Road right into a frenzy of shopping for and promoting shares.

A “watch social gathering” had been deliberate in Manhattan, in accordance with the Wall Road Journal, whereas Mr Huang, famed for his signature leather-based jacket, has been dubbed the “Taylor Swift of tech”.

Alvin Nguyen, senior analyst at Forrester, advised the BBC each Nvidia and Mr Huang have change into the “face of AI”.

This has helped the corporate up to now, however it may additionally damage its valuation if AI fails to ship after companies have invested billions of {dollars} within the expertise, Mr Nguyen mentioned.

“A thousand use circumstances for AI shouldn’t be sufficient. You want 1,000,000.”

Mr Nguyen additionally mentioned Nvidia’s first-mover benefit means it has market-leading merchandise, which its clients have spent a long time utilizing and has a “software program ecosystem”.

He mentioned that rivals, equivalent to Intel, may “chip away” at Nvidia’s market share in the event that they developed a greater product, although he mentioned this might take time.