British startup Penfold, a digital office pension supplier, introduced at present it has raised a €4.6 million funding spherical to develop its presence throughout the UK SME and accountancy markets and speed up the event of its pension app with new options for savers and companies.

The spherical as led by Gresham Home Ventures, a progress fairness investor specialising in software program and digitally pushed companies within the enterprise options, healthcare and shopper market sectors.

Chris Eastwood, Co-founder of Penfold, mentioned: “This funding from Gresham Home Ventures is a vote of confidence in our aim of bringing higher pension options to companies and savers and can allow us to additional improve our digital providing. Gresham Home Ventures has a unbelievable observe report of supporting fast-growing companies like ours so we’re assured this funding will allow us to speed up our latest momentum.”

Based in 2018, Penfold seems to be to rework the €9.4 trillion UK pensions trade by making saving for retirement “easy, accessible and fascinating“. Its platform permits employers to arrange and handle a pension, implement wage sacrifice, and supply worker advantages.

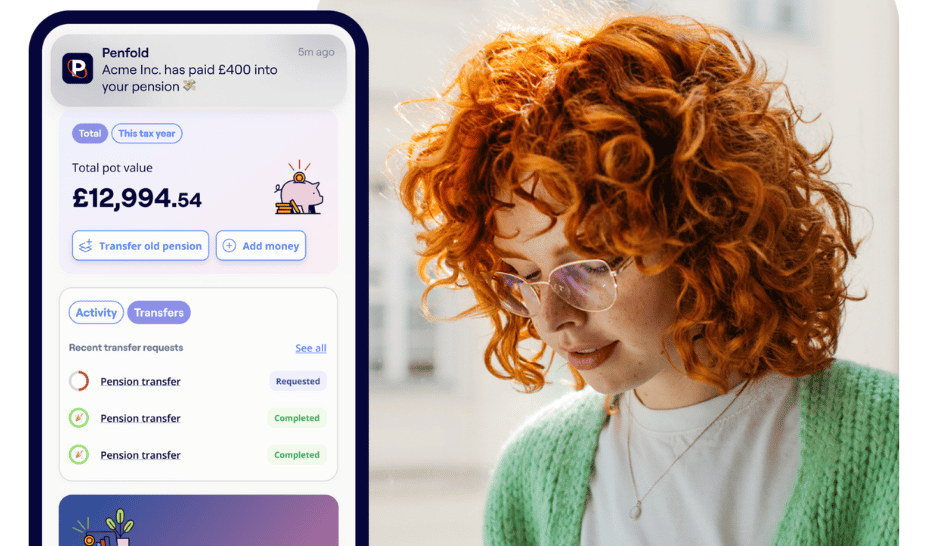

Penfold gives a digital office pension by way of a proprietary platform, which allows companies to enroll or swap their pension in minutes – in response to Penfold this can be a important enchancment over legacy suppliers.

The enterprise has seen important progress lately, with the variety of employers utilizing Penfold’s office pension tripling because the begin of 2024 – from 1,200 to over 4,000 – and belongings beneath administration rising by 91% to just about €830 million by the top of Q1 2025.

Penfold believes that this progress has been fueled by their free wage sacrifice implementation service, serving to SMEs lower your expenses on Nationwide Insurance coverage contributions, and the fast enlargement of its accountancy agency accomplice community.

The funding from Gresham Home Ventures will likely be used to additional develop Penfold’s presence throughout the UK SME and accountancy markets and speed up the event of its pension app with new options for savers and companies. The funding in Penfold will likely be held within the Baronsmead and Mobeus VCTs that are managed/suggested by Gresham Home.

The deal continues a busy interval for Gresham Home Ventures, with the enterprise at the moment fundraising for its Baronsmead VCTs. It has additionally been energetic when it comes to dealflow, having just lately led investments in accessibility audit and knowledge platform Mobility Mojo and journey journey scale-up A lot Higher Adventures.

Rohit Mathur, funding accomplice at Gresham Home Ventures, mentioned: “We’ve been impressed with Penfold’s industrial traction because it leads the cost in disrupting the pensions trade. With important potential to additional increase its buyer base and bolster its digital providing over the approaching years, we’re excited to help Penfold’s continued progress because it enters the subsequent section of its progress.”