In the event you run a distribution enterprise, the drill: A buyer rejects an bill over a purchase order order discrepancy, their cost phrases reset, and so they sit in your working capital whilst you pay 9%+ curiosity.

Let’s discover how a mid-sized distributor solved this by scaling their buy order-sales order verification course of earlier than delivery – with out including headcount or disrupting present workflows.

The true price of order discrepancies in distribution

Order discrepancies typically slip via to post-shipping discovery. It is inevitable once you’re processing 1000’s of orders month-to-month. However when your buyer rejects an bill as a result of their buy order (PO) does not match your gross sales order (SO), they are not simply making a headache — they’re holding onto your working capital.

For one mid-sized distributor processing 4,000 orders month-to-month, this meant vital prices and strained accounts receivable cycles. Their accounting workforce might solely manually confirm SOs in opposition to POs when the worth exceeded $10,000, leaving most shipments weak to expensive discrepancies.

At present rates of interest above 9%, each delayed cost hit laborious. As soon as supplies are delivered, clients have zero urgency to repair these points. Every bill revision resets cost phrases, making a expensive cycle of delays and dealing capital constraints. Past that, these discrepancies might additionally frustrate clients and doubtlessly result in the lack of future enterprise.

💡

Why stopping order discrepancies is extra advanced than it appears

In distribution, matching POs and SOs is not nearly evaluating numbers. Your clients may listing 10-inch 600-pound stainless-steel whilst you present 10-inch 600# SS. Some ship two-page POs, and others ship 60 pages with elaborate phrases and circumstances. Add a number of plant places, various cost phrases, and lot cost orders — verifying orders earlier than success turns into more and more difficult.

The distributor’s order processing workflow earlier than automation was typical of many industrial suppliers.

Order discrepancies create expensive downstream issues

Past the apparent time constraints, manually evaluating SOs in opposition to POs created a number of downstream issues that worsened over time.

Here is what was occurring:

- Solely orders above $10,000 could possibly be manually checked — leaving most orders unverified

- Every handbook matching took half-hour of senior accounting supervisor’s time

- Smaller orders have been shipped with out correct verification, carrying hidden dangers

- Discrepancies surfaced solely throughout invoicing, resulting in bill rejections

- Working capital and accounts receivable tied up for 60-90 days at ~9.5% curiosity

- Points found after delivery when clients had no urgency to repair

- Technical half descriptions assorted between clients and inside methods (Instance: ZP vs zinc plated), complicating handbook checks

- A number of delivery places shared zip codes however wanted completely different gate numbers, risking supply errors and dear reshipments

The time and price funding was substantial. As an example the accounting supervisor is making round $60.44/hour (median hourly wage for the role in the US) — that is a senior expertise you are paying to match POs line by line manually. For this distributor, with 734 high-value orders yearly and half-hour per test, that meant burning via $22,181 simply on handbook verification. And we’re not even counting the hours spent chasing corrections and different extra duties.

Moreover, the cost clock resets at any time when a buyer rejects an bill as a result of a discrepancy with the PO. So, at 9.5% curiosity, a 60-day delay on a single $10,000 order price them $158 in curiosity alone. Now multiply that throughout a whole lot of orders. Abruptly, these minor verification points are bleeding tens of 1000’s in curiosity prices yearly.

The distributor knew they wanted to catch PO-SO discrepancies earlier than delivery—after they nonetheless had leverage to get points mounted. However any resolution wanted to work alongside their present order processing and success workflow, not change it. That is after they approached us at Nanonets.

How we automated PO-SO matching

On this distributor’s case, automating order verification required vital change administration. Whereas we might automate your complete workflow from order entry to delivery, we knew that might contain retraining the gross sales workforce and disrupting established processes.

That is why we started by automating how they verified their gross sales orders in opposition to buy orders.

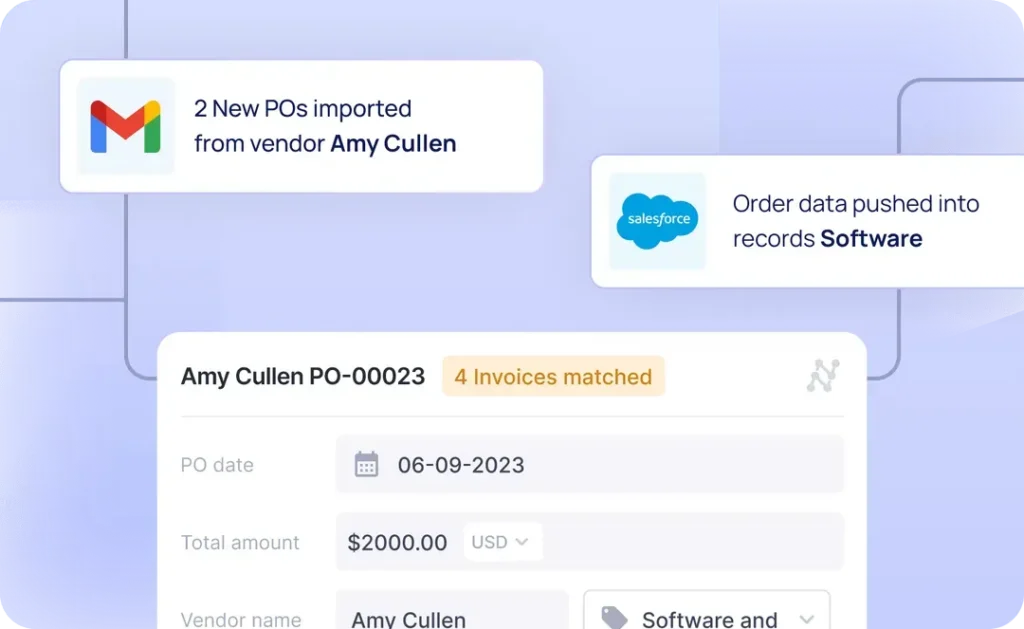

We realized we might ship quick worth right here. Nanonets built-in with the distributor’s Enterprise Edge ERP and doc administration system – streamlining buy and gross sales order seize. This fashion, the gross sales groups might maintain their present workflow whereas the automated order matching ran within the background, catching discrepancies earlier than they grew to become expensive issues.

Right here’s what the workflow regarded like:

- Gross sales workforce receives buy order and creates gross sales order as standard

- Buy order will get uploaded to their doc administration system

- Our system routinely detects new buy orders

- System pulls corresponding gross sales order particulars from Enterprise Edge

- System verifies gross sales order particulars in opposition to buy order

- Discrepancies get flagged earlier than delivery

- Order processing workforce receives alerts for evaluate

- All verifications get logged for monitoring and evaluation

The implementation course of

Working with the distributor, we took a phased method. We began with their highest-value orders above $10,000. This allowed them to benchmark our system in opposition to their present handbook verification course of whereas minimizing threat. Additionally they categorized their clients primarily based on verification wants — some required actual matches on each area, whereas others primarily targeted on totals and portions.

We labored with the distributor to coach our system to deal with these PO-SO variations. This included:

- Dealing with advanced layouts, codecs, and emailed orders

- Managing a number of plant places

- Understanding numerous product descriptions

- Processing completely different cost time period codecs

We arrange a number of every day checks throughout enterprise hours (7:30 AM – 4:30 PM CT). The system periodically checks for brand spanking new buy orders, pulls the corresponding gross sales order particulars from Enterprise Edge, and runs the verification course of — all within the background.

The system then routinely flags points primarily based on severity:

Vital points requiring quick consideration:

- Whole quantity mismatches

- PO quantity discrepancies

- Cost time period variations

Non-critical points for evaluate:

- Delivery element variations

- Line merchandise matches

- Handle format variations

This new automated workflow helped centralize their verification course of, with a devoted order processing position dealing with all system alerts. This ensured constant processing of flagged objects and exceptions whereas sustaining effectivity.

The influence of automated PO-SO matching on order processing

Inside 90 days, we helped them obtain a 90% STP (Straight By means of Processing) fee — the share of orders being verified routinely with none handbook intervention — and 90% accuracy in information extraction and matching. This was a major enchancment from the preliminary 70-75% accuracy fee throughout early implementation.

The outcomes have been transformative:

Operational enhancements:

- Simply processing 17-18 recordsdata every day via automated order matching

- Error charges decreased to only 1-2 points per batch requiring handbook evaluate

- Automated checks operating all through enterprise hours (7:30 AM – 4:30 PM CT)

- Deal with advanced distribution eventualities like will-call orders and a number of delivery places via customized guidelines

- Automated order matching protection expanded to all incoming orders – no extra $10,000 threshold

- Early PO-SO verification smoothed out downstream 3-way matching processes

- Diminished order cycle time from receipt to delivery

Monetary and money circulation influence:

- Order discrepancies caught earlier than delivery — when fixes are simpler

- Cost delays decreased via pre-shipping verification

- Diminished publicity to 9.5% rates of interest on delayed funds

- Senior accounting expertise redirected to strategic work

- Higher working capital administration via quicker bill reconciliation

- Curiosity prices minimized by stopping 60+ day cost delays

Course of enchancment:

- Centralized processing via devoted order processing position

- System routinely flags points primarily based on severity

- Actual-time alerts despatched to related workforce members

- Complete monitoring via Energy BI dashboards

- Customized validation guidelines for particular buyer necessities

- Automated exception flagging and opinions changed handbook line-by-line matching

The success led the distributor to create a devoted order processing place, dealing with the small share of orders that wanted human evaluate. This streamlined method maintained each the excessive STP fee and accuracy whereas scaling to deal with their full order quantity.